Offshore Banking: A Smart Solution for Expanding Your Possessions

Offshore banking provides a nuanced technique to possession diversity, offering people a method to navigate the intricacies of international financing. As we discover these aspects, the inquiry occurs: what are the essential elements to think about when choosing an offshore financial service?

Understanding Offshore Financial

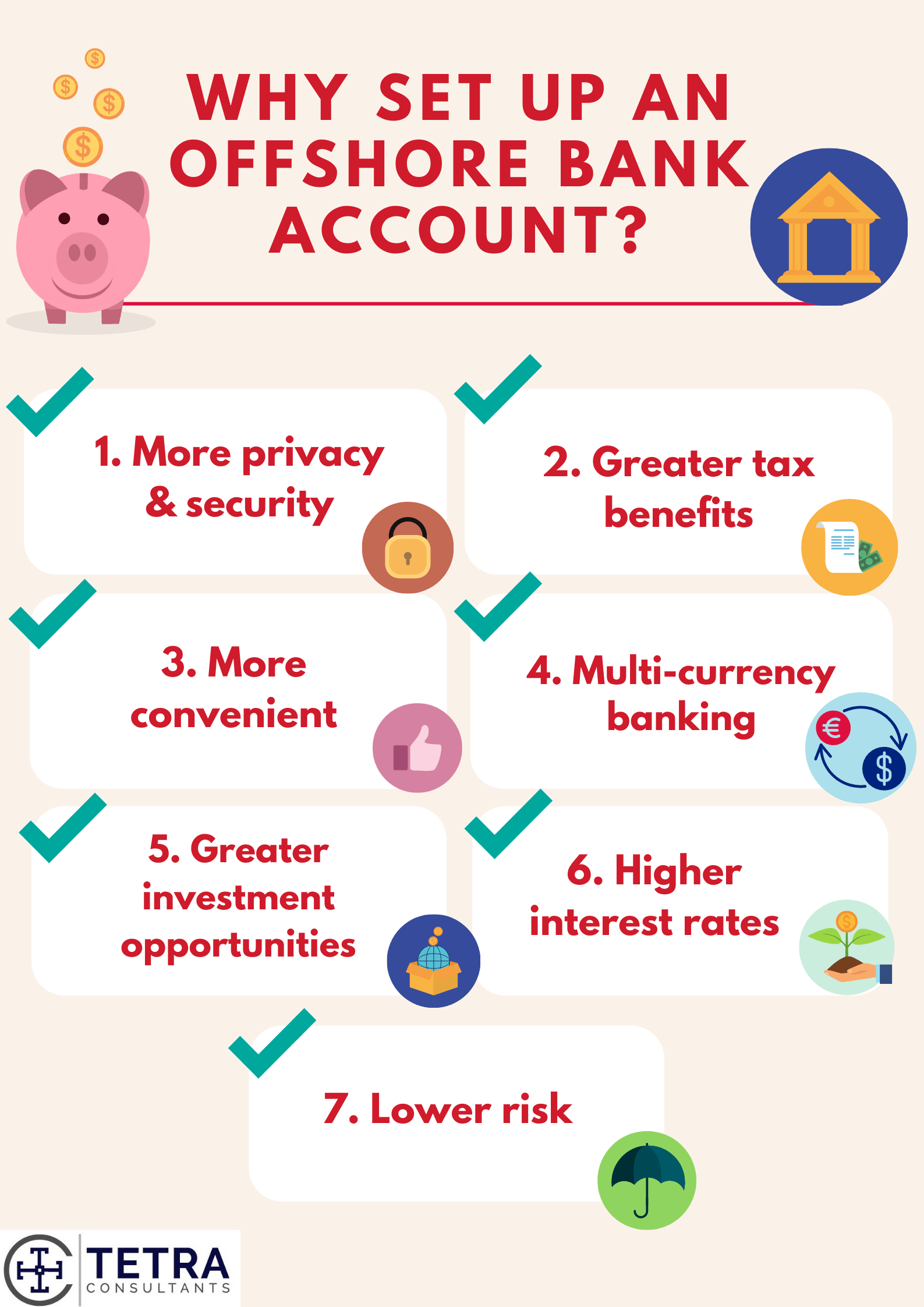

Although overseas banking is often linked with wealth monitoring and tax optimization, it fundamentally describes the practice of holding an account or investing in a financial institution located outside one's country of house. This practice enables individuals and services to access a variety of economic solutions that might not be readily available domestically. Offshore banks are normally established in territories with desirable regulatory environments, using boosted personal privacy and safety for account holders.

The concept of offshore financial can encompass different economic products, including savings accounts, investment accounts, and even car loan facilities, all made to cater to global customers. Offshore financial institutions frequently give solutions in numerous money, making it possible for customers to handle their properties better in a globalized economic climate.

Additionally, the regulatory structure controling offshore banking varies substantially from one jurisdiction to an additional, commonly characterized by lower compliance requirements and better discretion for account owners. While overseas banking can be a legitimate financial strategy, it is important for individuals and companies to recognize the lawful ramifications and duties related to preserving accounts abroad. Understanding of neighborhood policies and global contracts is important for making certain conformity and preventing potential mistakes.

Benefits of Offshore Accounts

In addition, offshore accounts typically give access to a broader range of financial investment opportunities that may not be readily available domestically. offshore banking. These accounts can consist of a range of economic instruments, such as international supplies, bonds, and common funds, enabling account owners to tailor their financial investment methods according to their risk tolerance and economic objectives

Another substantial advantage is the capacity for tax optimization. While tax policies vary by jurisdiction, some overseas accounts might use desirable tax treatment, enabling individuals and companies to boost their after-tax returns legally.

Moreover, overseas banking institutions typically employ innovative personal privacy measures, guarding account owners' financial information. This added layer of discretion can be attracting those seeking discretion in their financial events. Generally, the benefits of offshore accounts contribute to you can try this out more durable economic planning and management techniques.

Asset Protection Approaches

One efficient approach to safeguarding wealth entails applying robust asset security approaches. These methods are essential for people seeking to shield their properties from prospective dangers such as legal actions, financial institutions, or economic instability.

Integrating limited liability entities, such as offshore corporations or limited liability business (LLCs), can additionally supply a protective layer. These frameworks help insulate individual assets from business responsibilities, making certain that individual wide range continues to be safe in case of business-related lawful concerns.

Furthermore, diversifying financial investments throughout numerous property courses and geographical locations can reduce risk. This approach minimizes exposure to any type of single financial decline, boosting total economic security. offshore banking. By using these possession defense methods, individuals can successfully guard their wealth, guaranteeing it remains his response intact for future generations while browsing potential economic obstacles

Tax Obligation Benefits and Factors To Consider

Applying reliable asset security strategies frequently leads people to think about the tax obligation advantages connected with offshore financial. By opening up an overseas account, clients might gain from beneficial tax regimes offered by specific territories. Several nations provide tax rewards, including low or zero tax on rate of interest and resources gains, which can significantly enhance wealth accumulation.

Additionally, overseas banking can facilitate tax-efficient spending with diversified asset classes and money, enabling account owners to enhance their profiles. It is important to understand that while some overseas jurisdictions provide tax benefits, click reference conformity with international tax obligation legislations, including the Foreign Account Tax Compliance Act (FATCA), is mandatory. Failing to report overseas accounts can lead to serious penalties.

Furthermore, the perception of overseas financial as a tax obligation evasion tactic can bring about reputational risks. For that reason, individuals have to guarantee their offshore activities are transparent and legally certified. Consulting with tax experts who specialize in global financing is necessary for browsing these complexities and making the most of potential benefits while lessening obligations. Ultimately, while offshore financial can supply substantial tax benefits, cautious preparation and adherence to regulations are crucial to gaining these rewards responsibly.

Picking the Right Offshore Bank

Picking the best offshore financial institution is a critical decision that can considerably impact your monetary approach and possession defense. When considering an overseas financial establishment, it is important to review several essential variables, including the bank's reputation, governing atmosphere, and the solutions used.

First, conduct extensive research study on the bank's standing in the sector. Search for establishments with a tested performance history of security and safety and security. Regulative conformity is an additional important facet; ensure the financial institution abides by international criteria and runs within a credible territory.

Additionally, examine the array of solutions supplied. Some financial institutions may concentrate on wealth monitoring, while others concentrate on providing basic financial solutions. Consider your individual or business demands and pick a bank that lines up with your financial objectives.

One more essential variable is accessibility. Investigate the ease of communication with the financial institution, including language support and customer care schedule. Last but not least, think about the costs linked with account maintenance and transactions, as these can vary dramatically in between establishments.

Final Thought

In conclusion, offshore banking presents a feasible technique for possession diversification, providing various advantages such as enhanced financial protection and access to a bigger variety of financial investment opportunities. The incorporation of reliable property protection approaches and possible tax benefits better underscores the allure of overseas accounts.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!